- Mortgage Calculator Texas

- Mortgage Calculator Bankrate

- Mortgage Calculator

- Mortgage Calculator Payment Free Calculator

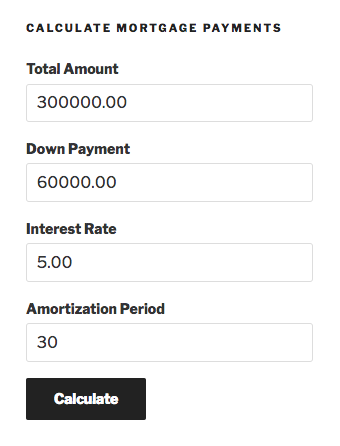

Calculate your monthly mortgage payments on your home based on term of your mortgage, interest rate, and mortgage loan amount. To include annual insurance and taxes in your calculations, use this mortgage calculator with taxes and insurance. A mortgage calculator is a springboard to helping you estimate your monthly mortgage payment and understand what it includes. Your next step after playing with the numbers.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components, property taxes, PMI, homeowner’s insurance and HOA fees. It also calculates the sum total of all payments including one-time down payment, total PITI amount and total HOA fees during the entire amortization period. If the monthly mortgage payment you’re seeing in the home loan calculator is higher than you can afford, here are a few things you can do to lower it. Improve your credit score If a low credit score is contributing to your high payments, you can take steps to increase it.

If You Know the Remaining Loan Term

Use this calculator if the term length of the remaining loan is known and there is information on the original loan – good for new loans or preexisting loans that have never been supplemented with any external payments.

Payoff in 15 years and 8 months

The remaining balance is $279,163.07. By paying extra $500.00 per month, the loan will be paid off in 15 years and 8 months. It is 9 years and 4 months earlier. This results in savings of $108,886.04 in interest.

| Monthly Pay | $2,298.65 |

| Total Payments | $538,628.53 |

| Total Interest | $238,628.53 |

| Remaining Payments | $430,709.43 |

| Remaining Interest | $151,546.36 |

The Original Payoff Schedule

| Monthly Pay | $1,798.65 |

| Total Payments | $647,514.57 |

| Total Interest | $347,514.57 |

| Remaining Payments | $539,595.47 |

| Remaining Interest | $260,432.40 |

If You Don't Know the Remaining Loan Term

Use this calculator if the term length of the remaining loan is not known. The unpaid principal balance, interest rate, and monthly payment values can be found in the monthly or quarterly mortgage statement.

Payoff in 14 years and 4 months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

| Remaining Term | 14 years and 4 months |

| Total Payments | $343,122.63 |

| Total Interest | $113,122.63 |

The Original Payoff Schedule

| Remaining Term | 24 years and 4 months |

| Total Payments | $437,677.36 |

| Total Interest | $207,677.36 |

Any typical amortization schedule, including mortgages, will have two elements in its financial structure: interest and principal. They are set up in a way where the majority amount of the beginning payments is interest, and only as it matures do portions of scheduled payments begin to sway towards principal repayment. The reasoning for this is that the outstanding balance on the total principal (which is very high at the beginning) requires heavy interest to upkeep. Only over time with diligent and continual scheduled payments will the outstanding balance decrease, alleviating the burden of high interest payments. The Mortgage Payoff Calculator and the accompanying Amortization Table illustrates this precisely. Just input several bits of information and it will give the pertinent data, answering many questions such as the exact year mortgage payments comprise more of principal than interest, how much interest is due in year 10, or whether it makes much more sense to put off the nice vacation to Hawaii to supplement extra $500 a month to an existing mortgage for the financial benefits.

Extra Payments Towards Mortgages

Ceteris paribus and not considering external financial opportunity costs (like an enticing bull market), any extra payments on top of scheduled mortgage payments can be beneficial from a financial standpoint because it relieves interest payment pressure. To illustrate, extra monthly payments of $6 towards a $200,000, 30-year loan can relieve four payments at the end of the mortgage – try it out on the calculator and see! The mortgage payoff calculator can also work out the contingencies of refinancing. With a 30-year, $100,000 loan at 5 percent interest, scheduled mortgage payments are $536.82. At the same rate, but on a 15-year payoff schedule, principal and interest payments are $790.79. That's $254 more a month, but ownership of the real estate is granted in a much shorter time and less interest is paid.

Mortgage Calculator Texas

Quick Tip 1: In most cases, it is more financially feasible to first pay off any high interest debt incurred (such as credit cards) before delving into the idea of supplementing a mortgage with extra payments.

Biweekly Payments

Another way of paying off the mortgage earlier is to set up biweekly payments. They take advantage of the fact that there are 52 weeks in the year and 12 months. Paying half the regular mortgage payment every other week results in 26 half-payments, or the equivalent of 13 full monthly payments at year's end. Generally, many will offer the service for free, but some banks will try to charge extra for setting them up. It is possible to negotiate a deal. Just be prepared to budget for these extra payments. However, any extra payments made only to the principal instead of into biweekly mortgage plans earn more interest for the lender in the end. Some lenders are sneaky and package biweekly mortgage plans with the extra two payments applied to principal at the end of the year, and not when the payments are immediately received! Don't fall for this!

Quick Tip 2: Try to refinance a mortgage to a lower rate of interest if possible. Just make sure to factor in closing costs to see if it is worthwhile. Remember, lower interest (or even no interest) is always better.

Important: There may be prepayment penalties associated with supplemental payments to a mortgage!

Prepayment Penalties

From a lender's perspective, mortgages are profitable investments that bring them years of income, and the last thing they want to see is their money-making machines compromised. There are two types of prepayment penalties: hard and soft. Hard prepayment penalties hit the borrower if they sell or refinance their mortgage. Soft prepayment penalties will hit with the penalty only if they choose to refinance their mortgage.

There are many different methods deployed by different lenders to calculate prepayment penalties. Two examples are 80% of six months' interest, or a percentage of the outstanding balance; so it can be a pretty heavy fine especially during the early stages of a mortgage.

However, unless the mortgage comes from shady loan sharks inside a dark pawn shop, prepayment penalties are generally less common nowadays. If they do happen to exist on a mortgage document, they are usually void after a certain period of time passes, such as after the fifth year. It's still important to read the fine print or ask the lender, just to be absolutely sure. Prepayment penalties are prohibited on FHA loans, VA loans, or any loans insured by federally chartered credit unions.

Mortgage Calculator Bankrate

Opportunity Costs are Everything

Generally, there are downsides to anyone who decides to put all their eggs in one basket. For many people, they have no choice but to do so when they decide to buy a home. Financial opportunity costs exist for every dollar spent. As an example, it is possible to argue that all the cash flow streaming into a mortgage could have been placed in the stock market instead, or a portfolio of corporate bonds, or even a physical supply of gold. Or, they could be better off reducing existing debt such as student loans. Depending on market directions in the future that no one can predict, some of these alternative investments may actually result in higher returns as opposed to paying off a mortgage, which technically is the equivalent of a low risk, low reward investment. As an example (in hindsight), it would make much more financial sense for an individual to have put a certain amount of money into a portfolio of high growth stocks that earned 15% one year as opposed to their existing mortgage at a 4% interest rate. Good alternative investments to consider before supplementing a mortgage with extra payments are tax-advantaged accounts such as IRA, Roth IRA, or 401k accounts.

Quick Tip 3: It would be wise to always be immediately clear to lenders that the supplemental payment for a mortgage sent to them should be applied towards the principal. For example, some banks require the written words 'payment toward principal' written on a check, or when doing an online payment, putting a check mark on what is intended to be done with the payment.

Examples to Help

At the end of the day, it is up to the individual to evaluate their unique situation to determine whether it makes the most financial sense to increase monthly payments towards their mortgage.

Example 1: Christine recently had to make such a decision. Because it filled her with a sense of happiness to one day proclaim herself as a proud owner of a beautiful home, she decided to supplement her mortgage with extra payments (after checking to make sure there were no prepayment penalties involved) to speed up the mortgage process. One day while having lunch with a friend who just happened to be a skilled financial advisor, she explained that the supplemental money going towards Christine's mortgage would be better off paying the existing high interest debt on her three credit cards, some of them reaching as high as 20%, which were eating up unnecessarily large amounts of her income. Christine is better off erasing her high interest debts of 20% before supplementing payments to her mortgage with a 5% interest rate because she is essentially removing the debt that is most draining first.

Example 2: Bob has all his debt and loans paid off except the mortgage on his family's home. Student loans, car loans, CC loans are all a thing of the past. With enough income to play with, he cannot decide whether to pay supplemental payments towards his mortgage or invest with high liquidity in the stock market because historically, it has higher returns than the alternative of erasing the 4% interest rate tied to his mortgage. He could also choose to put away more into his emergency fund, which is nearly empty. One important detail his financial advisor managed to squeeze out is that Bob's advertising company has been laying off employees left and right. His manager even warned Bob that he might be next in line. In this situation, Bob is better off adding to his emergency fund or keeping his investment liquid in the stock market in the unfortunate case he is laid off (even if he were to buy back at losses). A wise man once said it is much easier to uninvest than it is to un-prepay.

Example 3: Charles has absolutely no debt or loans except the mortgage on his house. He has a steady job where he's maxed out his tax-advantaged accounts, a healthy six-month emergency fund, and a large amount of cash saved up with no clue where to place his money (a good problem to have). He lives in a neighborhood geared for rapidly appreciating values over the next several years. He can choose to accelerate his mortgage payments with it, but other enticing offers are available such as blue chip stocks and corporate bonds. However, the economy has been in a downturn and the market is expected to continue tanking for the next several years. In this situation, a smart financial advisor would probably suggest avoiding the market sensitive stocks and bonds expected to drop drastically and focus on accelerating his mortgage to retain ownership of his home as fast as possible, as all other investments are predicted to perform worse.

After considering things like risk profile, existing investments, job security, market influences, and satisfying important emotional needs such as the pride of ownership in a real estate, or peace of mind in either finally hurdling a mortgage or having diversified investments, a person can decide whether it is a good decision to supplement their mortgage with extra payments.

The mortgage payoff calculator above is here to help!

Mortgage Calculator

Calculator Use

Calculate your monthly mortgage payments on your home based on term of your mortgage, interest rate, and mortgage loan amount. To include annual insurance and taxes in your calculations, use this mortgage calculator with taxes and insurance.

- Mortgage Amount

- the original principal amount of your mortgage when calculating a new mortgage or the current principal owed when calculating a current mortgage

- Mortgage Term

- the original term of your mortgage or the time left when calculating a current mortgage

- Interest Rate

- the annual nominal interest rate or stated rate on the loan. Note that this is the interest rate you are being charged which is different and normally lower than the Annual Percentage Rate (APR).

- Monthly Payment

- the payment amount to be paid on this mortgage on a monthly basis toward principal and interest only. This does not include insurance or taxes or escrow payments. (payment = principal + interest)

Mortgage Calculator Payment Free Calculator

Monthly Payment Calculation

Monthly mortgage payments are calculated using the following formula:

where n = is the term in number of months, PMT = monthly payment, i = monthly interest rate as a decimal (interest rate per year divided by 100 divided by 12), and PV = mortgage amount (present value).

Cite this content, page or calculator as:

Furey, Edward 'Mortgage Calculator'; CalculatorSoup, https://www.calculatorsoup.com - Online Calculators